Your Council rates go towards providing services and facilities for the community, and the cost of running our city.

This includes everything Council does, from collecting waste and maintaining roads, to buying library books and patrolling beaches.

Online payments

You can pay your rates through Council's Online Services system, or see the 'Other payment methods' section of this page for more options.

Pay as a registered user

If you have an account in our Online Services system, use the link below to log in, then click My Account, and select the item you'd like to pay.

Not registered yet? You can create an account by clicking the link Don't have an account? on the log in screen. See below for more information about setting up an account.

Pay as a guest user

If you don't have an online account, select the Pay Now option in Online Services.

In the Payment Reference field, enter the number shown in the payment options details at the bottom of your rates notice.

Our Online Services system is Council's one-stop-shop for applications, payments, reporting issues and more.

You can create an Online Services account to view your property and rates information, and pay your rates.

Have your rates notice handy and follow the steps below to create an account as an existing customer, and we'll match you up with your property.

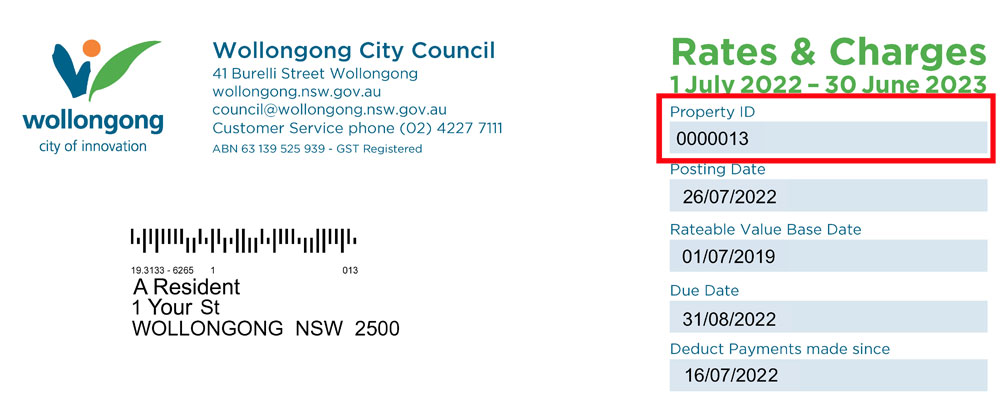

Register as an existing customer using your rates notice

- Follow the link to log in or register then click the link Don't have an account?

- Tick the box Are you an existing customer with Council?

- Enter the Property ID shown at the top of your rates notice.

- Enter your name exactly as shown on your rates notice.

- Complete all other relevant fields, then click Submit.

Please note, it may take several working days for your property information to appear in your online account.

Council launched a new Online Services system in mid-2022, which is now used to manage rates information and online payments.

Due to the recent change to our systems, the payment reference and biller codes for your rates notice have changed and must be updated for all future payments.

To avoid missing payments on your account, please make sure these details are updated as shown on your current rates notice.

You can also pay rates using these methods:

- Online via BPOINT with your Visa or Mastercard (please select the 'Portal Payment' option in the Biller Code field).

- Direct debit: set up automatic payments to come out of your account on a regular basis using our Direct Debit Ratepayers form PDF, 57.47 KB Make sure you read our Direct Debit Service Agreement PDF, 41.43 KB before setting up automatic payments.

- BPAY from your online cheque or savings account. Visit BPAY’s website or talk to your financial institution for details.

- Post Billpay at any Australia Post outlet, by calling 13 18 16, or on the Post Bill Pay website.

- Over the phone by Visa or Mastercard 24 hours a day, 7 days a week on 1300 672 936

- Mail a cheque to Locked Bag 8821, Wollongong DC 2500

- In person with cheque, credit card or EFTPOS at our Customer Service Centre, 41 Burelli Street, Wollongong between 8.30am and 5pm on working weekdays.

If you’re paying by cheque, make it payable to ‘Wollongong City Council’ and mark it ‘not negotiable’.

For all credit card payments, a 0.6% processing fee applies.

Please note, we are not able to accept AMEX card payments.

We send out rates notices in July each year. If you don’t pay in full, we will send you a reminder notice each quarter.

You can get your rates notice:

- By mail: We will automatically post notices to you unless you sign up for a different option.

- By email: register to get your rates notices by email. This option also lets you link multiple properties, see your rates history back to July 2022, and add a second recipient for rates notices.

- Through BPAY View: sign up to BPAY View to get bills and statements sent straight to your online financial account. Contact your financial institution if you need help with BPAY View.

How to read your rates notice

Download our guide below to help you understand the different parts of your rates notice.

How to read your rates and charges notice PDF, 250.96 KB

Copies of your rates notice

If you need a copy of your current rates notice, call us on (02) 4227 7111 during business hours. There’s no charge to get a copy of your current rates notice.

You can also apply online for rates notices from previous years only.

Before you can apply, you need to log in or register in our Online Services system.

Once you are logged in, select Lodge an Application, then Council Services and Rates Notice Copy.

Please note that fees apply for copies from previous financial years as shown below.

| Fee NameFee Name | GSTGST | Current Fee (incl. GST)Current Fee (incl. GST) |

|---|---|---|

| Fee NameProvide copy of Rate Notice | GSTN | Fee incl. GST$20.50 |

You can choose to pay your rates:

- In full by 31 August

- By quarterly instalments. Each instalment is due by:

- 31 August

- 30 November

- 28 February

- 31 May.

If you’re having trouble paying talk to us, ideally before the payment deadline.

Pensioners may be able to get a discount of up to $250 on their residential rates. To be eligible, you must:

- Hold a blue Centrelink concession card, or a Gold Card from the Department of Veterans’ Affairs (DVA, TPI, EDI); and

- Live at the property for which you receive the rates discount.

To request a pensioner rates discount, call us on (02) 4227 7111.

If you move house, you will need to re-apply to receive your pensioner discount at your new address.

For more information call us on (02) 4227 7111.

Pensioner Agreement to Defer Rates, Charges and Interest

In some cases, eligible pensioners can apply to have their rates payments deferred. Call us on (02) 4227 7111 to find out if this is an option for you.

If it is, use the Pensioner Agreement to Defer Rates, Charges and Interest form PDF, 38.13 KB to apply.

If you're facing financial difficulty, please talk to us as soon as possible about your rates or any payments owed to Council.

We have a Debt Recovery and Hardship Policy PDF, 189.31 KB and can discuss available options to suit your unique circumstances.

Please phone us on (02) 4227 7111 to talk about support for rates and payments.

You can also use our Hardship Rate Relief Application Form PDF, 83.02 KB to request hardship relief.

Under NSW law, certain types of land are exempt from some or all rates. This can include land owned by religious groups and schools.

If you think your property meets the state rules to be exempt from paying rates, you can apply for an exemption using the form below. Have a look at this flowchart. It’s a guide to help you understand whether your property is eligible for rate exemption under the state rules.

You can apply to have part of your rates postponed in some cases where it is used differently to how it's zoned.

For example, if you have a single home on land zoned for industrial use, a postponement may let you pay only the amount of rates that you would have applied if the land was zoned for a single home. That means you don't have to pay the extra amount straight away.

Rates postponement is complicated, so call us on (02) 4227 7111 to see if this is an option for you.

If you're ready to apply for a rates postponement, please complete and return the Postponed Payment of Rates form PDF, 35.65 KB

Update details for owners

Use this button to update your details if you are the property owner.

Update details for managing agents

Use this button to update details for managing agents (eg real estate agents).

Learn more about your rates

- Household Recycling and Waste

- Pay Your Rates

- Trees on Your Property

- Pets

- Maintaining Your Home

- Backyard Pools and Spas

- Update Your Details

-

My Suburb

- Austinmer

- Avondale

- Balgownie

- Bellambi

- Berkeley

- Brownsville

- Bulli

- Cleveland

- Clifton

- Coalcliff

- Coledale

- Coniston

- Cordeaux Heights

- Corrimal

- Cringila

- Dapto

- Darkes Forest

- Dombarton

- East Corrimal

- Fairy Meadow

- Farmborough Heights

- Fernhill

- Figtree

- Gwynneville

- Haywards Bay

- Helensburgh

- Horsley

- Huntley

- Keiraville

- Kanahooka

- Kembla Grange

- Kembla Heights

- Koonawarra

- Lake Heights

- Lilyvale

- Maddens Plains

- Mangerton

- Marshall Mount

- Mount Keira

- Mount Kembla

- Mount Ousley

- Mount Pleasant

- Mount Saint Thomas

- North Wollongong

- Otford

- Port Kembla

- Primbee

- Russell Vale

- Scarborough

- Spring Hill

- Stanwell Park

- Stanwell Tops

- Stream Hill

- Tarrawanna

- Thirroul

- Towradgi

- Unanderra

- Warrawong

- West Wollongong

- Windang

- Wollongong

- Wombarra

- Wongawilli

- Woonona

- Yallah

- New or Recently Moved Residents

- Business Owners